Research & Development (R&D) Tax Credits

Reclaim Funds for Your Business and Enhance Your Bottom Line

A comprehensive tax strategy is vital to your long-term business goals. You may even already have one in place. But many businesses find it challenging to fully maximize its value — to search every nook and cranny for incentive opportunities and pursue those found dollars. That’s how the R&D tax credit has come to be one of the most frequently underutilized incentives for businesses, regardless of size or industry.

What is the R&D tax credit?

Alternately referred to as the R&E credit or simply the “research credit,” the Research & Development tax credit was first introduced to stimulate innovation and advance U.S. technologies. It rewards innovative risk by offsetting federal income tax liability dollar for dollar, and in some cases, payroll tax liability. That means any expenses or payments devoted to research can be offset under this credit, immediately freeing up cash flow to be put back into your business. Many states (including California) provide a similar credit, potentially increasing the benefit.

What is considered a qualifying research expense?

This is the crux of why many businesses don’t take full advantage of this credit. Qualified Research Expenses (QREs) can be for any product, process, or software development or improvement in the service of a specific commercial objective. They can even be duplicative or derivative, and a company may be eligible whether their activities succeed or not. Expenses that can be offset with the credit include taxable wages, cost of supplies, and contract research expenses.

This is the crux of why many businesses don’t take full advantage of this credit. Qualified Research Expenses (QREs) can be for any product, process, or software development or improvement in the service of a specific commercial objective. They can even be duplicative or derivative, and a company may be eligible whether their activities succeed or not. Expenses that can be offset with the credit include taxable wages, cost of supplies, and contract research expenses.

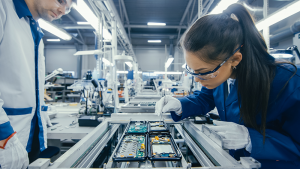

What kind of companies can benefit from the R&D tax credit?

Any company paying tax in the United States that has devoted resources to research activities can benefit. Size doesn’t matter: companies with $0 in sales and one employee can have R&D credits. You do not have to achieve a scientific breakthrough, invent something new, or make a revolutionary discovery. Almost every industry has reported R&D credits. Manufacturing, information, scientific, and technology companies tend to make up the bulk of claims, but only because their business activities are more obviously connected to research and experimentation. Each year, millions of dollars are claimed by companies in non-tech industries who are taking innovative risks in their space, including healthcare, entertainment, construction, real estate, hospitality, transportation, agriculture — the list goes on.

If the R&D credit is so fantastic, why aren’t more companies claiming it?

The R&D tax credit is highly misunderstood. While it doesn’t apply to everyone, it’s much more often the case that companies are eligible for the credit and have counted themselves out due to misinformation or perceived difficulty. There are persistent myths that the R&D credit is only for large corporations with dedicated research departments, or that the work has to be revolutionary. Perhaps you’ve heard that collecting and maintaining the proper records is a full-time job, or that claiming the credit is a red flag for the IRS. Not so. The size of the company doesn’t correlate to the size of the credit, because it is calculated based on qualified spending, not sales. Startups and smaller companies that pay alternative minimum tax may also be eligible. Activities don’t need to be groundbreaking and claiming the credit isn’t typically an audit flag. The credit can even be claimed for up to three prior tax years (four in the state of California). The paperwork requirements aren’t particularly onerous either. However, there are rules that govern this and other tax incentives, and many companies lack sufficient time and resources to devote to it.

Sky Law is ready to help with our deep expertise and tireless dedication to putting money back into your business. We work closely with you to design a legally sound tax strategy to boost your bottom line and accelerate your path to growth. Let’s talk about what incentive opportunities may exist for your business.